In the world of investment management, there's a widespread problem of mediocre results. This isn't because passive investment strategies are brilliant, but rather because the academic understanding of a statistical concept called "mean reversion" has been distorted. Some psychologists and economists have won Nobel prizes by misusing the concept in their theories, which has led to a mistaken belief that active investment managers are generally incompetent.

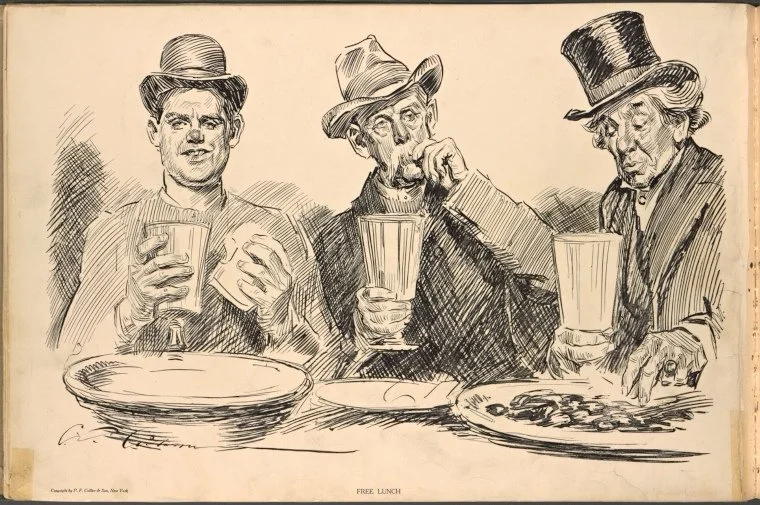

Free lunch was a tradition once common in saloons in the US. It was a sales enticement that offered a meal at no cost to attract customers and build patronage. So popular was the scheme that a complete meal was offered with a 15 cents drink and people used to throng to such saloons, a few of them even complaining about the quality of food. On the other hand, it was Milton Friedman who popularized the term ‘No free lunch’ with his book. The term meant that in reality, a person or a society cannot get “something for nothing”. In mathematical finance, this was an informal synonym for the no-arbitrage principle.

Starting with the fundamental idea of an “emerging market economy”, it’s role, utility and dynamics in the current global set up as a balancing economic block, the paper analysis Goldman Sach’s emerging BRIC’s countries model in context of the pre and post 2008 financial crisis. The paper looks at micro and macroeconomic valuations, currency and the economic cycles to illustrate changes in the four economies. Using Japan as a developed economy, the paper also makes a comparative approach and tries to forecast the economic development of the block and respective relation among these countries.

At a farewell party last night, we found that five of us had the same birthday, which was quite a coincidence as the gathering was small. There, a friend from Lebanon who is a senior techie at a Fortune 500 infrastructure company asked me to explain how such recurring coincidences take place often. There was no traditional answer to his question. I told him that just like clustering of market prices was a cyclical reality, and such coincidences happen again and again with cyclical precision.