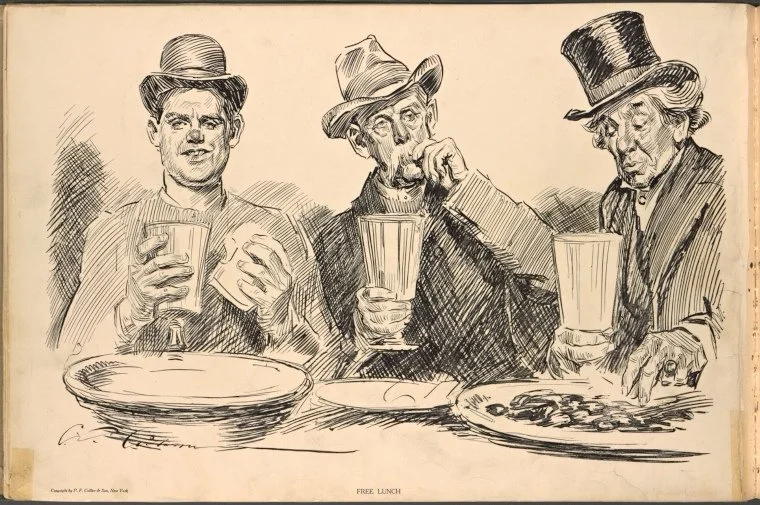

Free lunch was a tradition once common in saloons in the US. It was a sales enticement that offered a meal at no cost to attract customers and build patronage. So popular was the scheme that a complete meal was offered with a 15 cents drink and people used to throng to such saloons, a few of them even complaining about the quality of food. On the other hand, it was Milton Friedman who popularized the term ‘No free lunch’ with his book. The term meant that in reality, a person or a society cannot get “something for nothing”. In mathematical finance, this was an informal synonym for the no-arbitrage principle.

Not all the ETFs that you love have zero fees. Some still charge 3% and even more. ETFs is the Free lunch which translates in simple language “don’t ask us for relative out-performance” or beating the benchmark. The loss is all yours to keep, the fee, whatever we can charge is ours to keep.

The 1968 study by Michael Jensen studied performance for 1945-64. Essentially, Jensen found that all mutual fund alphas were indistinguishable from zero. Although there have been different studies done on the hot hand effect, beating the market has been known to be an unassailable feat. If a system could beat the market, the market participants could not just arbitrage away the gains, the cost of generating such a system are low, the profits sizeable to take out transaction costs, then that system would be a new free-lunch opportunity.

Did Indexing Dow Jones as early as 1884 offered a free lunch to market participants? A novel opportunity, a diversified lower risk approach, compared to individually holding the components, a clear perceived value. Although it took more than 100 years for index futures to be traded on the index or exchange-traded fund (ETF), allowing investing opportunities based on the index, the fact that the system persisted till now is proof of longevity, sustainability, visibility, and economic sense. This is clear proof of an opportunity for low-cost participation in the market, which is harder to beat by mutual funds at a comparative risk level. The businesses built around indexing and the smart money-tracking innovation also confirm this. Today, more than a trillion dollars track passive indices like Dow globally. What started as a simple financial innovation spawned a new market.

137 years later, we are still juicing the Indexing innovation. Why did the free lunch innovation stop? There is a scarcity when it comes to free lunch financial innovations. A few reasons: First; there are fewer information gaps. Information drove the financial innovation business. Now with fewer information gaps, building financial innovations based on information is harder. Second; the perception that we have had enough financial innovation and we have reached a peak for financial knowledge. Hence, we can’t have any more financial innovations. Third; market mood. Hedge funds and shorts are easy to blame for a crisis. Why build financial innovation, if buy and ride are for free.

This is the whole idea. The ride is not for free. The lunch is not going to be expensive, it would be life-changing. I had a plumber tell me in 2007, how naive I was to not buy real estate. Plumbers are good people too, and so are the other well-intentioned shoeshine boys, it’s the euphoric times that should scare us. Great things come out of a crisis and it will happen, even if it’s hard to fathom the why. And when it will happen, the free lunch will kill one industry for sure, no one will ever pay for the claim of relative return "beta". There will be only one return and that will be absolute, rest everything else would be buried under the free lunch cutlery.