ML systems blindly designed around fundamental factors claiming factor timing should serve their clients better by revisiting the poor record of fundamental forecasting. AI is not biased because it is incapable, AI is biased because, for more than 100 years, we naively and relentlessly believe that we can make orange juice from apples every time we get a new tech juicer.

First published on Sep 15, 2007.

Demand-supply dynamics are not only differentiating economics from finance but reshaping capital market research.

At a farewell party last night, we found that five of us had the same birthday, which was quite a coincidence as the gathering was small. There, a friend from Lebanon who is a senior techie at a Fortune 500 infrastructure company asked me to explain how such recurring coincidences take place often. There was no traditional answer to his question. I told him that just like clustering of market prices was a cyclical reality, and such coincidences happen again and again with cyclical precision.

The age of confluence is full of many such coincidences and witnesses a mixture of cultures, thoughts, sciences, information, and above all the human emotion, which continues to oscillate from one extreme to the other, changing the way we comprehend and see things. This is why time and again traditional research has come under fire. How accurate is it? How accountable and how relevant?

The Indian legend of the six blind men and the elephant fits the predicament well. The blind men are the traditionalists trying to understand what they can’t see. It’s not because they are blindfolded, but because the tools they use are archaic and only explain a part of the picture. Times have changed, as a neuroscientist, physicist, biologist, psychologist, and historian are challenging the economist on his home turf.

The new age brings with it an overload of information and a host of parameters, which are humanly impossible to interpret and analyze. This is why what we have been doing for a long time, analyzing and valuing markets based on available information and demand and supply gaps is futile. A recent paper suggests that we got it all wrong and there were certain subjects like economics and finance we should never have mixed in the first place. The new model of finance suggested by Robert Prechter and Wayne D Parker in the Journal of Behavioral Finance explains why our tools are ineffective and why fundamental analysis does not work in markets.

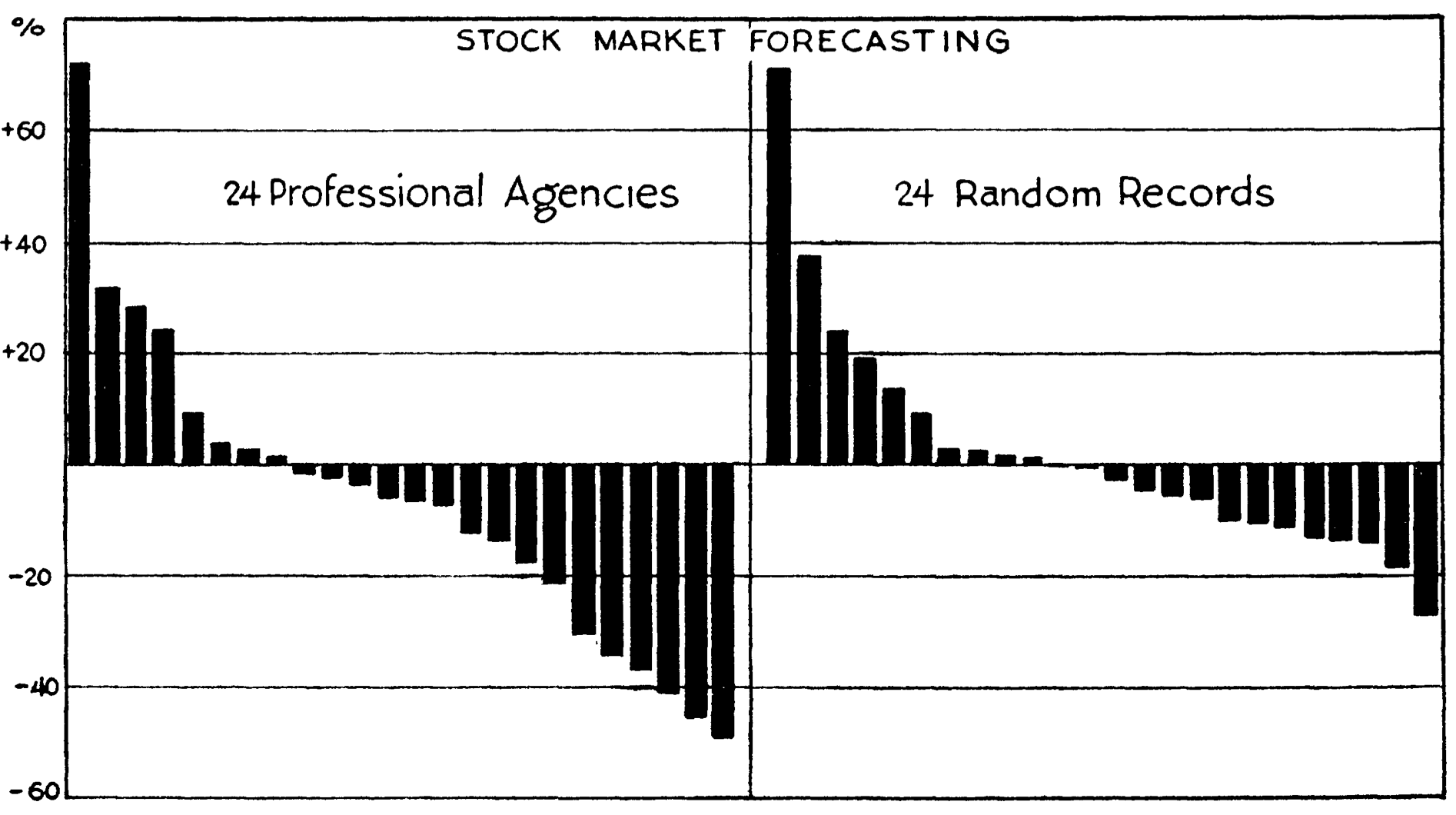

The fundamental analyst calculates an intrinsic fundamental value using several objective features, such as the company’s industry position, sales trends, profit margins and earnings, asset composition and liquidity, and its mix of financing. However, the market may not always reflect this value and may deviate owing to investors’ non-rational emotions. The analyst makes two assumptions here. One that the emotion is temporary and second, that the markets will revert to the mean after rationality returns. According to Stephen F LeRoy, an economics professor at the University of California, Santa Barbara, “The only problem with fundamental analysis was that it appeared not to work.” And economist Alfred Cowles’s study showed that fundamental analysts’ forecasts yielded worse results than random choice.[1]

Can Stock Market Forecasters Forecast?

No wonder the world’s best research company had an accuracy of 34 percent. The report was published by Bloomberg last year.

Stock price action over the past ten years has especially confounded fundamental analysts, who have watched share prices fluctuate wildly despite little change in traditional “fundamental value” (or in some cases despite no fundamental value at all). The data also suggests that the stock market is blissfully unaware of the dividend discount model and the earnings discount model. Financial market prices are not stable but dynamic, and they are not dependent upon but rather substantially independent of supposedly related “fundamental” values. And from the point of view of fundamental analysis, prices spend far more time deviating from the mean and the “fair value” than reflecting them.

Prechter and Parker [2] also define economic and financial markets. The former catering to utilitarian goods and services, while the latter for investments and speculations. Demand and supply relationships differentiate economic from financial markets. In economic markets, demand generally rises as prices fall and vice versa. In financial markets, demand generally rises as prices rise and vice versa. This difference is essential because the behavior of economic markets is compatible with the law of supply and demand, while the behavior of financial markets is not.

Sensitivity to oil prices explains the economic behavior well, as people change transport habits to cut back on consumption. Higher the price, more sensitive and subdued the demand. On the other hand, in finance, prices do not influence behavior in this manner. The volume of trading in the stock market goes up with the price. Higher the price, the higher the demand.

Prechter and Parker explain the new socionomic theory of finance that should replace the dysfunctional old Efficient Market model. Prices are driven by the mood of the majority as they herd. Valuations are a direct measure of investor optimism or pessimism about the valuations they believe others will place on stock prices. What is new in Socionomics is that social mood trends are unconsciously determined by endogenous dynamics, not consciously determined by the rational evaluation of external factors, and investors’ unconsciously regulated moods are the primary determinant of the direction of stock prices.

The paper rekindles the old debate of how we are using the wrong economic model for the financial markets. The traditional way to value markets and assets with demand-supply gaps is flawed. The global equity research model is dead. “From the Ashes of the Equity Research Model” was a report issued by the Tabb group in April 2006. The report claimed that the business model for research was broken and the death of the equity research model had unfolded over the past 10 years as investors migrated toward passive investment strategies, lower transaction costs, and self-directed electronic trading. And if economic models like Efficient Market Hypothesis were believed, it was impossible to outperform the market and that meant that investment research ultimately had no value. The big bucks were in large-cap research. And even this left a huge section of mid-cap and small-cap under-researched and under-serviced.

An alternative model of research is already thriving in the US, and it’s only a matter of time that it is accepted globally. The new capital market research model should be different from the old one and clarify some broad misconceptions of traditional research such as capital market research is free; it is linked with money management revenue; it is incapable of earning big bucks on its own; it needs domain knowledge ie to know about coffee plantations all over the world to forecast coffee prices; it means access to privileged information; it is extrapolation; it is resource-intensive; it is not accurate and accountable; it cannot be global and local at the same time and it can never be a standalone business. Non-traditional research addresses all these misconceptions and a research revolution is already underway. What we need is a few more coincidences, a few more questions, and an elephant to blow the blinds away.

[1] Can Stock Market Forecasters Forecast, Alfred Cowles, 31 Dec, 1932

[2] The Financial/Economic Dichotomy in Social Behavioral Dynamics, Journal of Behavioural Finance, Vol 8,Nr. 2, 2007