This session will cover:

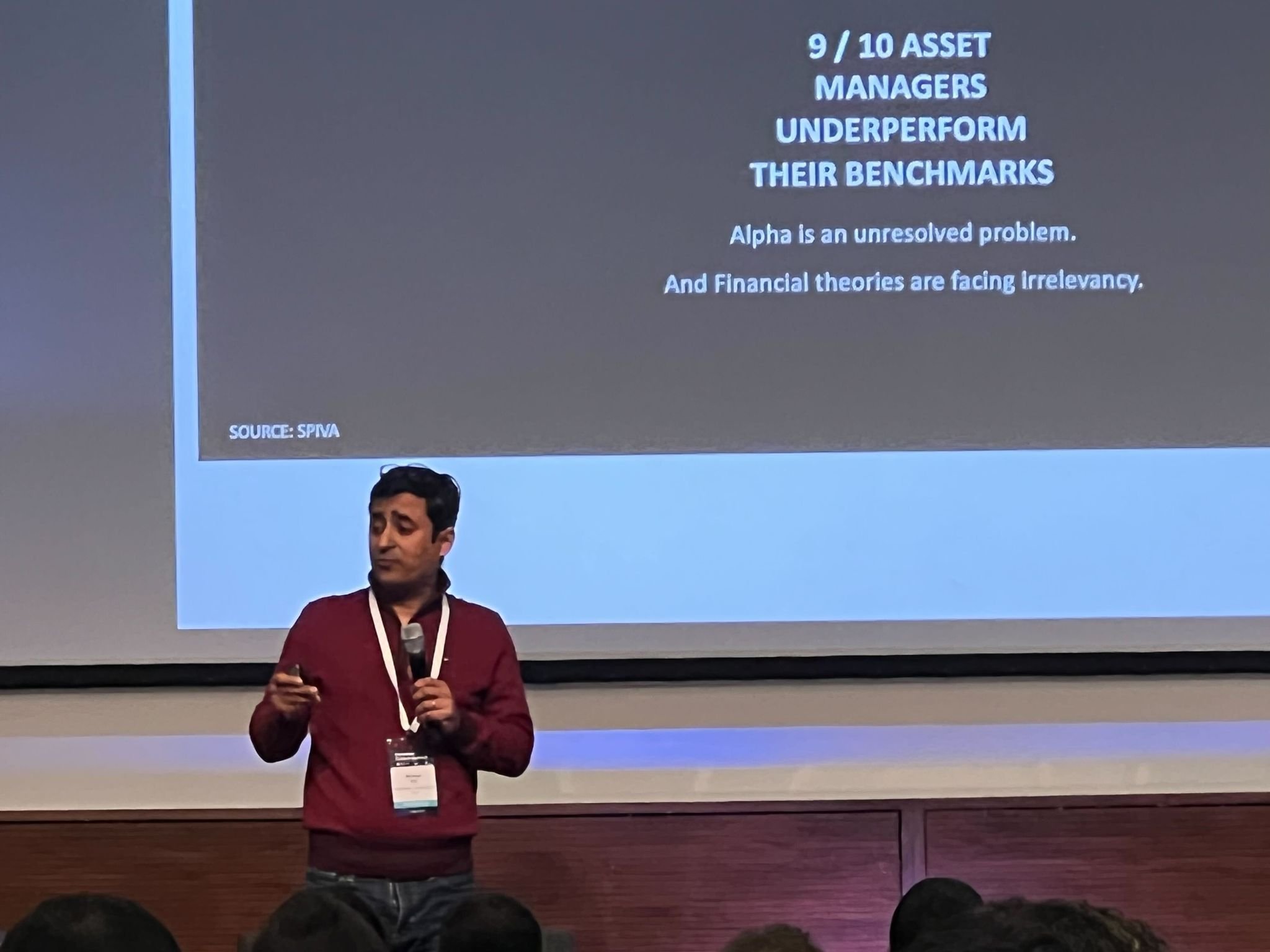

1. Understanding the Passive vs. Active Investing Debate:

• Analyze the historical context and debate between passive and active investing strategies, and how automated systems can resolve this with data-driven insights.

2. Exploring Statistical Factors in Investment Strategies:

• Understand how statistical factors like value, momentum, and size enhance portfolio performance and reduce risk in automated models.

3. MCAP vs. 3N Methodology:

• Explore how the 3N methodology addresses MCAP indexing inefficiencies to build next-generation smart beta indexes.

4. Validation Processes in Automated Investing:

• Learn techniques to ensure the robustness and reliability of machine learning models in predicting market trends.

How will AI resolve your wealth problem!

AMI(www.aminpo.org)Innovation and Investment Forum was held in Toronto, Ontario Canada on Oct. 29th. Representatives from global leading investment institutions, top innovation companies and leading enterprises attended the event which covered opportunities in AT/FinTech and Healthcare industry.

My interview with ZF where Bogdan asks me fascinating questions on psychology, markets, information, AI etc.

Finance is a key frontier for AI. Imagine coming back from vacation and talking to your virtual assistant about your investment portfolio and wondering how he does it, quarter after quarter, year after year. Managing money is the real human AI. It has to talk, it has to think, it has to have intuition and it has to make money.

Why should an investment analyst need a special skill set different from that of a sports analyst, a beverage company executive, a scientist, a social change agent, or the key decision makers in the government. Data, and its interpretation, is what connects us all despite our domains. We may not always be able to reconcile sub-atomic data with stock market data as both of them vibrate at a different frequency, but that does not change some universal laws which are present in every data set, irrespective of its natural source. Statistical laws are not only at the heart of physics, but also drive how we look at data. This means that there is the overlooked influence of ‘Data Universality’. Universality can be defined as “The aspects of a system’s behavior which are independent of the behavior of its components. And even systems whose elements differ widely may nevertheless have common emergent features”, Therefore, Data Universality can be defined as the “common universal behavior of any data set irrespective of its organic source of generation or derivation.” The talk on Data Universality will explain the disconnect between Pareto’s 80-20 and Galton’s Mean Reversion; how investing styles can be simplified; how Capital Asset Pricing Model can be transformed into a framework for modeling growth and decay of any natural variable driven by data.