The nearly USD 50 trillion passive investment management industry has grown over the last 50 years primarily based on the claim that 9 out of 10 Asset managers can’t beat the market, net of fees over a 5-year rolling period. This claim assumes that the S&P 500 has a superior methodology that is unassailable. Modern financial theory and the industry practitioners never questioned the respective claim, conveniently assuming it to be correct. This led to extreme fee pressure on the nearly USD 100 trillion active managers who found themselves academically defenceless to explain, why they could not generate alpha consistently.

We are in an Alternative Assets revolution. Crypto might be the most popular of the Web3 liquid alternatives [Alts] but as disintermediation picks up momentum, the new internet will lead to wealth redistribution by first taking away market share from the legacy world and then generating new opportunities in form of data assets that will be bought and sold like stocks on the blockchain marketplace.

James Clerk Maxwell conjured a demon in 1867 to explain the unexplainable behavior of quantum systems.

When I saw this research paper, its catchy headline pulled me like a magnet. The decade-old paper by Baumeister, Bratslavsky, Finkenauer, and Vohs goes about explaining how life is full of bad and good instances and how bad was predictive, underestimated, more lasting, more pervasive, elicited more processing, got more attention, was more unusual, was connected to speedy decision making, universal and simply stronger than the good.

I had the opportunity to pitch AlphaBlock at the Canadian Fintech Forum conference on April 5, 2022 organized by the amazing team at Framework Venture Partners. And though I had the best response ever for AlphaBlock as a business and an idea, with a ton of positivity, trickling even on day 2 of the event, I saw a lot of interest in “how we do, what we do”. At some level, I was surprised, having internationally spoken and presented at various platforms for decades, to see more than a normal round of applause.

Adam Smith and Thomas Malthus met and discussed the "Invisible Hand". I wrote this fiction as a part of an assignment while attending a creative writing program at Wesleyan University in 2017 wishing and imagining a meeting of the giants.

Real Assets and Bread

The cheap cost of money is one reason why markets discount negative news and continue to rise despite any short-term negativity. Once we remove zero cost of money from the equation, the 50% global wealth, blowing off its top, calmly, the global real estate which is not a real asset, could create a new hard-to-comprehend risk

If a month back you knew that Wheat is going to go to historical highs, Oil is going to skyrocket, War would break out and a few million people would leave their homes, you need not go further. Breaking news is not breaking, it's after the fact and has a miserable record of timing the market. Even though the information age started with innovation, it has started consuming us and has become an unruly horse, which even if we could ride, takes us somewhere else, not to the intelligent land, where we want to be. For alpha (intelligence) to happen we need a speed breaker for our emotional response to information, not speed-breakers for information.

War can be understood as an informational state, a mechanism that oscillates from imbalance to balance like any other natural mechanism.

Intelligence does not need data. History is the most elegant form of Intelligence which allows harnessing the past to understand the future. The mechanism manipulates myopic societal memory to dynamically function and create balance from imbalance. Nature works because it has a way of working secretly.

Because intelligent investing can’t happen in a world with extreme currency risk, the intelligence assisting in asset management would need to understand currency risk. Now with the world entering the digital currencies alternative asset boom, currency risk needs a rethink. At a certain level, a global currency has to be stable, lower in volatility and also have tangible value like Gold. Peter Bernstein's "Power of Gold" gives insight into the history of Gold as a currency. The future of stable currency could belong to digital currencies and the innovation around them, if they could balance the difficult path between value and utility.

Payment irrespective of alpha in the asset management industry is an ESG issue that needs to be addressed urgently if the industry has to evolve.

This is a story of finding a universality, transforming it into an indexing innovation, persisting with it, bringing it to Canada, and revolutionizing DIY Investing.

A draft of wind nudged a lucky snowflake to bond with another snowflake to make a chain. As it rolled down the mountain, the chain attracted more snowflakes, snowflake by snowflake, transforming into a snowball, a power to reckon, a momentous force, a phenomenon, that makes you wonder, was the snowflake lucky or did it persevere to be at the right time at the right place.

9 out of 10 asset managers don’t beat the market. This is driving the ‘Do It Yourself ‘(DIY) rush to passive. Below I explain how what should have been a 50% chance to beat the market became a poor hand for the asset managers and how the intelligent future is going to break the game.

Garry Kasparov’s book ‘Deep Thinking’ [1] is brilliant and full of insights for the machine Intelligence seeking world.

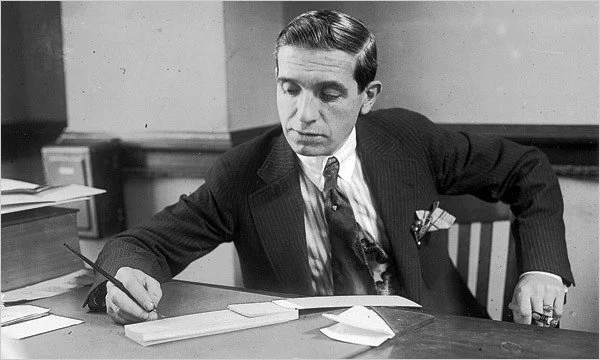

I am delivering a talk on financial crimes [1] on 16th December 2021 and decided to speak about Madoff’s Ponzi scheme which was worth about $64.8 billion in 2008 [2] before the recession brought the fraud in open. Harry Markopolos sent a letter, “The World’s Largest Hedge Fund is a Fraud” [3] to the SEC on November 7, 2005, highlighting about 30 red flags regarding Madoff’s operations and why there was extremely likely chance that he was running a Ponzi scheme. The Report of Investigation [4] issued by the United States Securities and Exchange Commission Office of the Inspector General found that...

Electrons when observed passing through two slits behave like particles and when left unobserved show wave interference like a ripple action in a pond. Why electrons calm down and get into a meditative state somehow obliging the observer is a quantum mystery, which has its roots back in 1901 when Max Planck [1] first used the word quanta. Nature is intelligent because she conserves and prospers seamlessly and perpetually and understanding her intelligence mechanism is where Science begins.

There are 35T’s driven passively while 65T’s are driven actively. The former is the Asset owner - the pensions, the endowments, the sovereigns, the families, and the individual investor sitting on the trade screen looking at his 401K account go up and down daily.

If factors can explain, almost everything and then flip, or stop to work and alpha that was there yesterday suddenly vanishes, there is only up to some time you can play this magic trick and keep laughing. Eventually, the reality that Alpha is a tragedy of commons, and just because it’s not my job or your job, doesn’t mean it will solve itself.

Intelligence is about solving a chaotic problem, you can see the manifold (the butterfly wings) but never exactly know when and which wing will the form flip too. Data is the bottleneck and the gold mine when it comes to building such systems.