I had the opportunity to pitch AlphaBlock at the Canadian Fintech Forum conference on April 5, 2022 organized by the amazing team at Framework Venture Partners. And though I had the best response ever for AlphaBlock as a business and an idea, with a ton of positivity, trickling even on day 2 of the event, I saw a lot of interest in “how we do, what we do”. At some level, I was surprised, having internationally spoken and presented at various platforms for decades, to see more than a normal round of applause.

Before the event, as normally it is, scripting, preparing, and dry running with family and friends, which of course is critical, this time around, I wanted to do something different. Call it the COVID work from home effect, or the underbelly fire startup effect, I wanted to take risk. I wanted to say something, I had never said before. I wanted to lay the truth out there. And guess what, my presentation had an Orange in the center spread. Yes! An Orange defines our capability as a business.

Post pitch, I fielded a lot of questions about the investment management industry, the method, the business, and its impact. The conversations for people who missed my pitch and saw me acknowledging supportive gestures started with…

Peer: “So what do you do?”

Me: “We are an automated Smart Beta company. I am assuming, you would like me to explain what’s Smart Beta”

Peer: “Yes, Please!”

Me: “Have you heard about S&P 500?”

Peer: “Yes” [of course!]

Me: “So as you know, the S&P500 is a 500 components basket, which is also sometimes referred to as the benchmark. This benchmark is built on a 150 plus-year-old method, which gives higher weight to the higher value companies”

Peer: “Yes! Yes” [Nods in agreement]

Me: “A new method that takes the same 500 components and builds a new index that beats the existing S&P 500 is called Smart Beta”

Peer: Hmm! Interesting

Me: “The method can only be smart if it beats the S&P 500 consistently. This new method, our method, can take any basket and beat it with a 5-10% excess return, on a risk-weighted basis, with low tracking error and low turnover.”

Peer: “Wow!”

Me: [Nodding this time] “And the best part, we have built the tech to offer it hands-free.”

Peer: Speechless and bewildered

Me: “Our vision is to become Uber for Asset Management. The world’s biggest asset manager with no assets. As you can imagine, something like this which can build products for G30 countries, different asset classes, and even Smart Beta on a basket of ETFs, can never address compliance at a global level. So we aspire just to be the highway that you or any asset manager can use to make more returns; hands-free!”

Peer: “This is brilliant!”

Me: “I know and by the way, our product is called Exceptional & Rich!”

Peer: “How did you even come up with that product name?”

Me: “Well! I did not. A man called Adrian Docea came up with it in 2014. An ad creative from Transylvania knowing what we do, said, investing should not be standard and poor, it should be Exceptional & Rich. It took us 8 years to believe what he saw as a product then”

Peer: “You! Guys should be Rich. This is simply too good to be true”

Me: “I know.”

Peer: “Why do you need to even raise money!”

Me: “Yes! You are right. A product like this is sustainable from the get-go, but don’t you think, the investors of the world could be better with such an innovation. A 1% fee on $ 100 trillion is a trillion dollars saved every year and if you get 5% annualized, excess returns, that is a lot of impact. And don't you think it's time a 150-year-old global wealth benchmarking method is improved.”

and the conversation went on...

Below is my 5 mins pitch.

We Build Machines that Beat the Market.

I am going to speak about something that has never been done.

The investment management industry relies on a 150 year old method.

We are here to change that.

The Problem.

9/10 of Asset Managers underperform their benchmarks.

Alpha is an unresolved problem.

Financial theories are facing irrelevancy.

This has forced the 150 year old, $ 35 trillion passive method to overtake the $ 65 trillion Active Investing.

Consequently

The $ 65 trillion Active industry will be forced to reduce their 1-3% annual management fee or drop it to zero, or simply be paid for performance.

While the Passive has one big problem that is growing. Concentration.

6 Companies of the S&P 500 are 30% of all its value.

We all own, more and more of the same thing.

All this herding is happening because the society considers information just as content, like an Orange, which can be juiced but not reused.

AlphaBlock resolves this problem with its New Informational Architecture...

Which is General and works across regions and assets.

Which is Replicable... consistent, robust and testable.

Which is Contextual...we are content agnostic and don't need fundamental data to deliver 5-10% risk weighted annualized excess returns.

AlphaBlock's Technology is automated, versatile and hands-free.

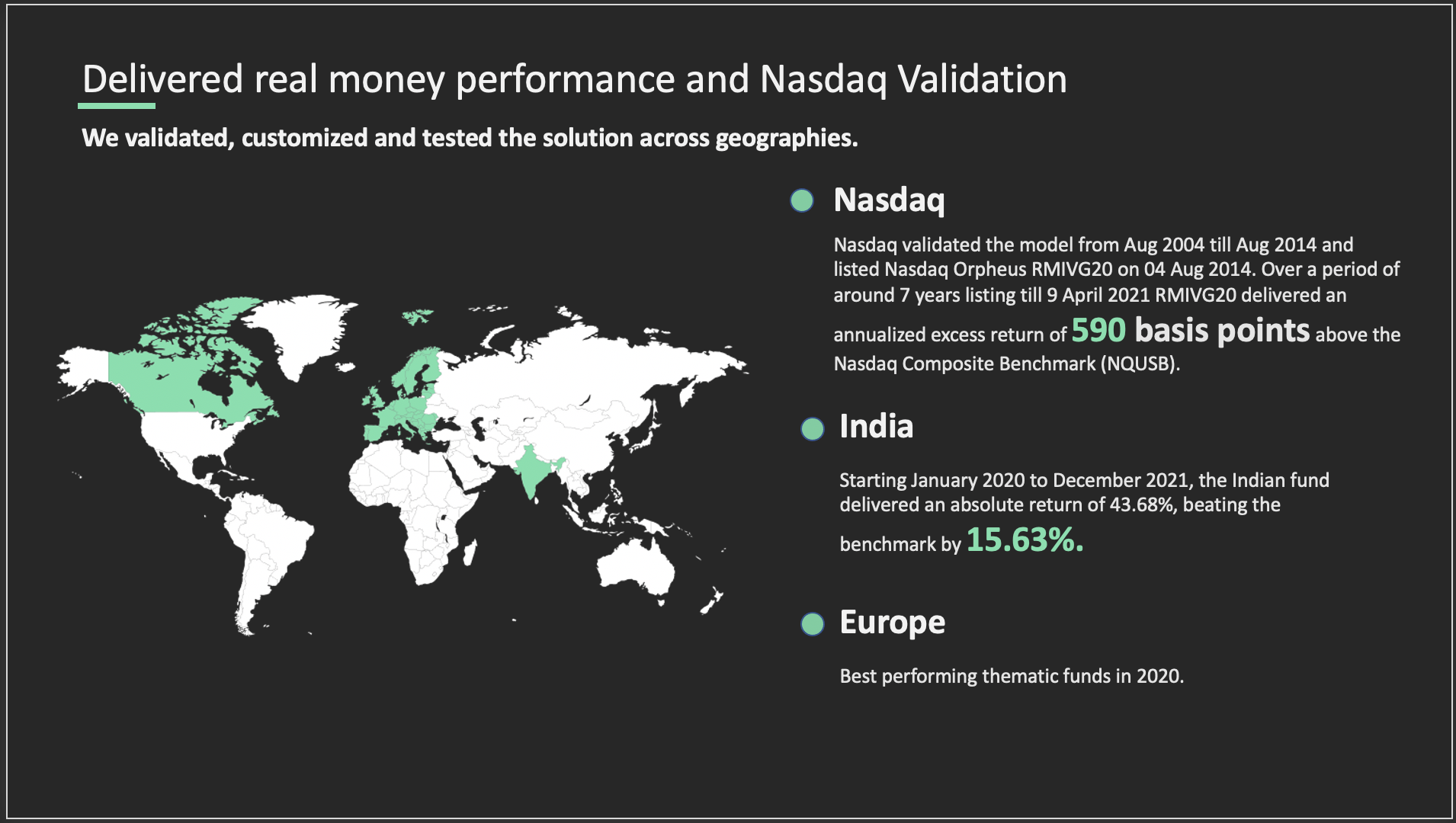

And has delivered real money returns across geographies and assets.

And allows any investor, asset owner, asset manager to select from a host of mandates, simulate those mandates across starting points and analytics and create a portfolio and use our turnkey execution APIs for implementation.

Such capability allows us to become a building block for You [pointing to the audience] the DIY investing community, for asset owners like pension funds wanting to generate more for longer living pensioners, for asset managers who are looking for differentiating alpha generating solutions in a time of reducing fees, for zero fee brokers and advisors who want to offer more investing products to their members and for service providers seeking alternative data.

The pricing is free for the first portfolio, for the second onwards it's a quarterly performance fee share on the alpha and outperformance on the benchmark we generate and for the B2B we have bespoke solutions starting $25K and with a license fee on assets.

We are already running mandates and have users and plan to onboard 1000 B2C users and 25 B2B mandates by end of the year.

We have a team with decades of experience in Capital Market Research, Banking Technology, Trading Platforms and Institutional Product Sales.

We are not alone in our journey and have been supported by great validations, partners and clients.

Our current fundraise is primarily going to be used for technology, research and scaling.

We would love you to join us in our journey.