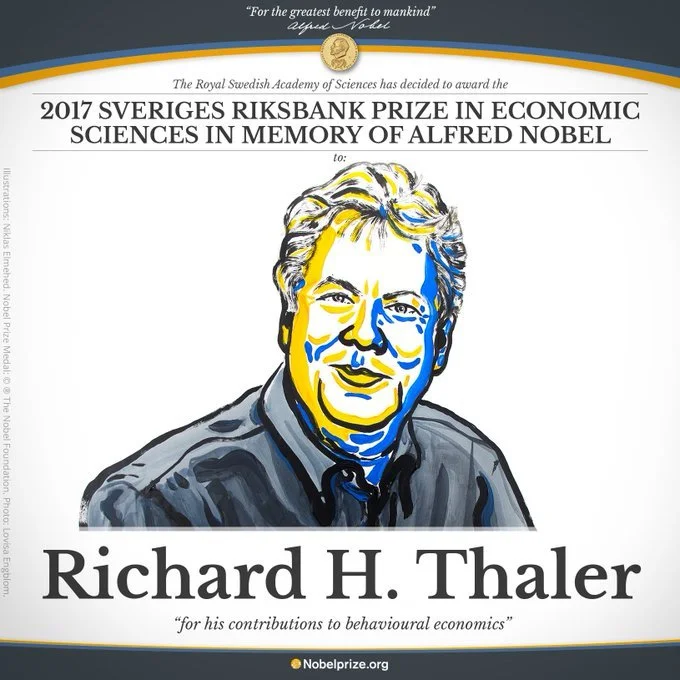

I really don’t know why Richard Thaler chose this headline for a research paper. Many other behavioral finance academic papers also capture attention. “Can the markets add and subtract?”; “The winner’s curse”; “The gambler’s fallacy”, “Does the stock market overreact?” While the popularity of the subject has increased and behavioral biases have got so pervasive that everybody seems to be biased, the question is whether the behavioral finance experts are bias-free?