While Robert Solow suggested not to think of Economics as Science [1], Andrew Lo warned us about the dangers of using Physics to build economic systems [2]. Physics has been a late entrant to the world of Finance. The subject has reached critical mass to answer some of the biggest challenges of Finance of the last 50 years. The Nobel Prize-winning Finance has failed to reconcile efficiency and inefficiency, forcing the global money to rely on the Efficient Market Hypothesis (EMH) as the last standing hypothesis, which can neither be rejected nor accepted [3]. This has left trillions of dollars in Pension funds clueless regarding what to rely on. The consequence could be an unintended risk, which the society is not prepared for.

Though Smart Beta [4] has brought in rule-based thinking, it is primarily catering as an ‘Active’ [5] solution to changing market cycles. Its foundation of financial theories remains structurally weak, the reason the industry does not have a coherent definition of the term Smart Beta. There is factor [6] proliferation, conflicting explanations of outperformance, lack of differentiation, and a host of unanswered questions like why naive allocation [7] is better than factor selection? Is Multi-Factor better than Single Factor? Does everything that avoids MCAP [8] concentrated exposure Smart? Whether timing helps or does not? And larger questions like what drives the persistence of Premia? [9] Will we ever take on Granger’s (1992) challenge to build a better alternative to EMH? [10] The solution providers are simply riding on the growth of the segment [11] relying on their institutional clients to comprehend the risk and invest.

Finance needs Physics to bring the needed clarity, usher in simplified factor thinking, move away from causal thinking and look at markets in a very objective quantifiable way to answer the various questions and explain the need and persistence of Free Lunch [12] (Premia). The author makes the case by restating market Alpha [13] as a process driven by the ‘Reversion - Diversion’ Framework [14] that is at the heart of the “Rich Get Richer” [15] phenomenon. The paper explains how a simple probabilistic classification can address the insufficiencies of a behavioral [16] or market efficiency [17] model, explain how Smart and Dumb beta [18] work together and how Physics and the science of complex networks [19] can be the savior for Finance.

Is Physics Dangerous?

Economics is not Science

Late Party Crasher and Nobel Prize Finance

Smart Finance is old wine, new Bottle

Market Capitalization (MCAP) Conflicts

Factors and Persistence of Premia

The Institutional Customer Alibi

Combination, Timing, and Correlation

Diversification and Investability

Selection and Allocation

Cyclicality

Unsubstantiated claims and lack of differentiation

Underperformance, Arbitrage, Free Lunch

Granger’s Challenge

Reversible Framework

Physics

Preferential Attachment and Detachment

Mean Reversion Framework

Reversion and Diversion Factor

Rich doesn’t always get Richer

Factor Simplification

Factor Causal Explanation

Smart and Dumb Free Lunch

Risk, Prediction, and Uncertainty

Case Study

Conclusion

Bibliography

1. Is Physics Dangerous?

The assumption that it is the human behavior that drives markets has driven a few generations of researchers [20]. I guess we had to take this journey before finding better roads. It is the overlap of statistics, mathematics, psychology, and physics, which motivates research today. When Andrew Lo wrote a paper labeled, “WARNING: Physics Envy May Be Hazardous to your wealth!”[21], it was not that physicists did not take notice, it is that they may have had nothing to say about it. Economics and Finance give an inordinate weightage to human emotion, but even with more than 50 years of behavioral finance [22], economists are still struggling to explain the coexistence of efficiency and inefficiency in markets. Inefficiency is assumed to arise because of behavioral anomalies [23].

Though our focus on behavior has not found us the answers we as a society find it hard to let go of our behavioral assumptions and look beyond. In my write-up on “What is Value?” (Pal, 2016) [24], I explained how economists misinterpreted the idea of Value and narrowly defined it as fundamental when it should have been considered statistical in the first place. In another paper “End of Behavioral

Finance” (Pal, 2013) [25] I explained how Richard Thaler’s overconfidence [26] was misplaced as behavioral follies could be seen as a failure of robust statistical laws and the more relevant question to ask was, why robust laws fail rather than blame it on the human folly.

In another earlier work, I explained how Andrew Lo’s Adaptive Market Hypothesis (AMH) [27] embraces the Efficient Market Hypothesis (EMH) [28] as an idealization that is economically unrealizable, but which serves as a useful benchmark for measuring relative efficiency. AMH’s adaptability to changing dynamics of the market suggests that investors are capable of an optimal dynamic allocation. There is nothing wrong here in the direction pointed by Andrew Lo. However, the assumption that human innovation-driven adaptability is the way ahead is an open-ended solution. This leaves little room for system thinking and overrules the possibility that natural systems could explain human behavior rather than vice versa. AMH just like EMH is based on a set of assumptions, which are good for illustrating market idealizations but lack in terms of addressing contradictions. This makes both AMH and EMH a philosophy rather than a system framework. Reversion Diversion Hypothesis (RDH) (Pal, 2015) [29] reconciles the contradictory assumptions into a statistical framework that addresses the limitations of EMH, AMH and extends the idea of a natural system functioning to markets.

Andrew’s warning [30] regarding physics also makes assumptions that just because physical systems are inherently simpler and more stable they can not map an economic system. Stock markets are physical natural systems that can be understood probabilistically and have an architecture that accepts the noise that accompanies social systems. In the Mean Reversion Framework [31], I explained how Reversion and Diversion systems work in a stock market and how the non-linear framework can explain the functioning of a market consequently explaining how systems can drive behavior rather than vice versa.

2. Economics is not Science

Finance as a subject has evolved from Economics and Economics is not Science. It is a social science. According to Robert Solow, “it is a mistake to think of economics as a Science with a capital S. There is no economic theory of everything, and attempts to construct one seems to merge toward a Theory of Nothing” [32]. Behavioral models have failed to give us a consistent framework regarding the function of markets. Behavioral models also have a temporal limitation [33].

The reason physicists could not crash the party till now was because of one unanswered question. Why sometimes trends don’t persist [34]? Why sometimes it is the late entrant who crashes the party?

Failure has been the most misunderstood part of Science. Why do robust laws fail? Before he died, physicist and Nobel laureate Werner Heisenberg had two questions for God. These were “Why relativity? Why turbulence?” Heisenberg also felt that God knew the answer just for the first question. Turbulence was beyond God. [35] It is strange the conviction Heisenberg had regarding turbulence also known as fluctuation, noise, divergence, extremity, the fat tail, chaos, black swan, etc. Economists have taken Finance from evolution to confusion. It is time Science takes over.

One of the key ideas of Herbert Simon was to understand how Pareto [36] worked. How did the trend persist [37]? Laszlo Barabasi’s [38] work also failed to explain why sometimes there is a divergence from the RGR, or why does on occasions, the first-mover advantage fails to keep the incumbent ahead. How come sometimes, a non-descript late entrant, a search engine (Google) ends up becoming bigger than the first search engine (Yahoo)? Laszlo Barabasi called it the luck factor [39]. The challenge against Barabasi was brought by Keller [40], Shalizi [41], etc. This brought in a need for a new architecture [42]. Something that could explain why sometimes the first mover could fail and the second or late entrant could succeed. In other words, it could also explain how mean reversion worked along with Praetorian divergence (exaggeration of trends).

3. Late Party Crasher and Nobel Prize Finance

Why is the question of the failure of RGR so relevant for Finance? And why are physicists so happy being the last one at the party? It is not strange that just by explaining why sometimes a phenomenon fails to happen you could solve multiple mysteries of Finance? You solve more mysteries even outside finance, but let us stick to Wealth for now and to the reasons why the financial theories fail. RGR is about trend continuation. RGR’s failure is about the rest.

It is Science explaining why trends and counter-trends happen, why the Capital Asset Pricing Model [43] (CAPM) works and fails? Why do Size [44] and Value [45] effects deliver? Though Shiller’s fluctuations [46] might be about human insanity but is the formation of market bubbles a Science? Stock Markets and nature are about Reversion and Diversion. Just like in nature, in stock markets, prices undergo Reversion and Diversion. And when they do that, the human mind looks for causality and explanations. Putting a scientific reason behind Reversion and Diversion is another way to explain why sometimes the Rich do not get Richer. Nobel Prize Finance is a problem for Physics because financial theories are built on explaining why things work not why they fail.

150 years of research has seen more than a few robust laws. The reason even robust patterns fail is that nature’s mechanism is about Reversion (order) and Diversion (disorder) while the robust laws which seek universal patterns focus on identifying order (stable forms) within chaos. Researchers have been unable to explain the Science of trend continuation and reversal in one common language that drives everything natural.

Answering why Rich sometimes doesn’t get Richer explains why sometimes first-mover advantage does not last. Finance is not built for explaining laws, but for observing behavior. It is for Physics to explain why a trend persists and why the same trend fails? This is why when Finance engages in explanations it becomes storytelling [46]. Finance can not explain why risk premiums work? Why correlations move from low to high? Why a factor characteristic explaining performance returns is relevant today and irrelevant tomorrow? The fads of today which become failures tomorrow are connected to the Rich get Richer phenomenon and its failure.

This is why stock markets could be seen as natural systems where the system drives the behavior and not vice versa. If hemline length of skirts [47] started driving bull markets we are no better than our ancestors who believed the earth was at the center of the universe. It is time we brought down the walls, rejecting what is opaque for ideas and systems that are transparent and simple. Moreover, if your mom can understand it, you can explain it to Sam, the firefighter from Idaho. [48]

4. Smart Finance is old wine, new Bottle

Smart Finance (aka Smart Beta) claims to know the right way to invest [O] [49]. It has the Sharpe Factor [49], the stacked up performance [49], an excess return to the benchmark, a superior rule, a smart performance. The six factors that have historically earned a long-term risk premium represent exposure to systematic sources of risk are considered to be Value, Low Size, Low Volatility, High Yield, Quality, and Momentum [M][50]. Factors are believed to be broad, persistent drivers of returns, present both across and within asset classes [B][51]. Smart Finance is considered as a compliment or a replacement for both Active and Passive mandates. [S][52] The academic literature sometimes back the product pitches which are based on empirical studies tout that the factors have exhibited excess returns above the market. [M][50]. Factors are explained as any characteristic relating to a group of securities that is important in explaining returns and risk [M][51]. A few consider the most recent innovation in beta as the introduction of explicit multi-factor approaches [J][52]. The approach is believed to be repeatable, transparent, cheap to access [J] [52], and has persistent characteristics [O][49]. We would have all gone home happy, if this was not old wine in a new bottle, failed financial theories repacked as new.

5. Market Capitalization (MCAP) Conflicts

A few consider Smart Finance as new rules to change weights of constituents [O][49]. Passive investing was introduced more than 50 years back and it was assumed to inadvertently take on varying unintended factor risk [O][49]. But there is limited consensus regarding what is not market capitalization-weighted (MCAP) is smart. A few believe that not everything that avoids cap-weighted is smart [J][52]. But maintain that avoiding large concentrations is beneficial for a portfolio [J][52]. A few players are more categorical suggesting that factor index investing is not a replacement for an MCAP index investing [M][50]. A few consider an MCAP as the complete opportunity set of equity investments while the factor indexes as baskets that do not reflect the full opportunity[50]. Instead, they represent strategic tilts away from MCAP. An active decision away from the MCAP [50]. This is like tumbling before the race. If the industry can not define Smart Beta coherently how can it explain Alpha? Is MCAP a failed idea? Is MCAP the only benchmark to measure performance?

In the paper, Why is CAPM not CRAP? (Pal, 2015) [53] I took on James Montier’s acronym (Completely Redundant Asset Price Model) [54] to explain that models fail and hence can not be trashed just because they fail to explain every market condition. A lot of researchers focus on causally explaining mean reversion failures, or simply putting, divergence from idealized cases. This is why a divergence from a proposed behavior, made CAPM a poor idealization. We continue to seek better-idealized scenarios, but somewhere we forget that markets are not made of one idealization, but a set of idealizations.

6. Factors and Persistence of Premia

The persistence of compensation earned from Premia [J][52] is believed to be effective [49] and driven by different economic rationales which tend to outperform at different times [51][B]. But how does one isolate the factor? What drives the investment returns? One can consider Revenue [49] [O] as a key factor, but this conflicts with the history of factor research, which discussed the failure of earnings as a predictor (Klien, 77) [54]. Even if Smart Finance does not care, Institutions should care what Klien or a history of financial economists said about the working and failure of factors and why it is important to look beyond a certain proxy [55]. A few players who believe that when factors with low correlation are combined, risk-adjusted outcomes can be improved [J][52] do not cite whether the combination ever fails? What if there is another 2008 like event? For what duration should the factors be combined? The returns are assumed to result from assuming equity risk, which comes at a premium. There is no question asked regarding why the equity premium happens in the first place? There is no anxiety around the possibility that the equity premium ceases to exist? A few who dare to ask, whether the excess returns will persist [M] [50] do not hesitate to point towards behavioral biases, which could keep other aberrations running.

7. The Institutional Customer Alibi

Anticipation comes with the Active nature of Smart Finance. A few players anticipate that investors can distinguish factors that offer a premium from the factors that just offer risk [J][52]. It is surprising how Smart Finance solution providers can leave it to the institutions to figure out the risk. Moreover, the industry abhors prediction but embraces it when it comes to assuming customer knowledge and prowess to discern between financial solutions and investing choices. A few Smart Finance players believe that structuring of the portfolios can earn returns not only by gaining exposure to risk factors that offer a premium but also by active hedging of that exposure to uncompensated risk. The assumption that the final risk belongs to the institution and he understands it seems like an alibi.

Based on investor’s investment criteria and objectives, the hands-off approach seems to lack ethics [S] [56]. A few players believe that the investors are better off identifying factors they believe in and staying diversified across factors seems to be the best choice till prices exaggerate [A][57]. Another player suggests that if a factor embodies risk the investor is likely to be compensated over the long term [J][52]. Wherever there are limitations, there are behavioral explanations of risk aversion and structural constraints such as index definition and conditions imposed by particular investment mandates. The institutional customer alibi is everywhere, whether it is about his preferences, or it is about his knowledge to discern between available choices, or knowing how to hedge.

8. Combination, Timing, and Correlation

Why multi-factor instead of single factor? A few players consider that over the short term, the performance of the single factors can be cyclical. On one side academic research is cited regarding the long-term outperformance of value, quality, and low vol. While on the other, the players accept that individual factors can and do experience periods of underperformance relative to market cap-weighted indices, making them difficult to time correctly [S][56]. So there is confusion regarding factor timing. Some believe that establishing an explicit timing mechanism for the initial investment is essential [M] [50]. But other caution against factor timing also pointing that factors have weak timing ability [A][57].

Premia is believed to often have a low correlation to one another and can perform well in different market environments. Many Smart Finance players believe that the key to diversification at the factor level is to identify factors with low correlation to the market and one another. It is believed that it is from the combination that the diversification benefit arises [J][52]. A few players focussed on currency hedging point out the problem with forecasting correlation and that correlation is unstable and a statistic that is sensitive both to the time periodicity of returns and the amount of historical data incorporated [D][58].

The jargons can be daunting if you try to decipher - the combined portfolio valuation and momentum factors can offset the purchases it might have made from the momentum factor against sales from the valuation factor, retaining the correct exposure to both without transacting [J][52]. It does not end here. Because Smart Finance is primarily active, players claim to have abilities to tilt [59], be cautious in risky periods, when correlations tend to increase and the benefit of diversification decrease[B][51]. The players encourage investors to consider a tilt with modest discretion at business cycle frequencies consistent with the broad, historically persistent nature of factors [B][51].

The responsibility still lies with the institution who should understand what goes into factor performance. The client is believed to capable enough to potentially guide himself to a balanced view. A few players advise that multi-factor be at the core of the portfolio and individual factor around the core is advantageous. Such an approach is believed to bring the diversification advantage and harness the time-varying nature. Single Factor is suggested for tilts and multi-factor for long-term diversification.

It is shocking to read through what is being sold as Smart Finance. But just because nobody wants to resolve the conflict does not mean that the Ostrich problem [60] is going away.

9. Diversification

Diversification across factors could have historically led to lower volatility and higher Sharpe ratios, higher information ratios and lower tracking errors and less regime dependency over business cycles as some players suggest [M][50]. But it is still hard to understand the specificity of diversification. Sector level diversification has proved to be powerful, naive, and hard to explain [J][52]. Why not rely on naive allocation than work on Smart Finance methodologies where factors compete with each other? A large number of factors are believed to improve a smart beta portfolio, all else being equal [J][52]. It is all else that is never equal which brings the risk into the investing equation.

Even the idea of an equal sector weighted index outperformance against the MCAP through multiple cycles [J][52] though relevant is not an apple to apple comparison. Turnover is an essential element when it comes to comparing strategies. An equal-weighted strategy has a disadvantage of a large turnover. Also the reason an equal-weighted approach delivers because it is not styled biased. Sooner or later a style or factor is prone to reversion. An equal-weighted model performance also works against the single factor approach. Own everything equal weight and beat the market or in other words, be more Active and beat Passive. The industry has a lot of similar solutions packaged differently. Rather a few even go ahead and express that multi-factor is value investing [A][57].

10. Selection, Allocation and Investability

The more you dig into the available smart finance methodologies, the more you see that the industry is more about selection than allocation. Why is that? Rule-based selection is easier than rule-based allocation. Taking 300 stocks out of 1000 and showing outperformance is easier than taking the same 1000 and rebuilding the basket. This is an important test for filtering out the replica methodologies from the ones with merit. Building an S&P 500 with the same 500, similar risk, similar turnover, and give risk-weighted excess returns is the litmus test for Smart Finance. And when you use the same allocation rules and build FTSE 100, STOXX50, TSX60, NIFTY50, ATX Prime is when you see the methodologies falling by the wayside. And if you add Bonds to the asset list, the list of Smart Finance providers reduces. The list gets nowhere when you add commodities, currencies, and alternatives.

Another opinion is that capturing multiple Premia can be more efficient in terms of implementation - lower turnover[J][52]. As there is a tradeoff between the pure exposure to the factor and the model's investability [M][50]. This is true if the methodology is about selection and not allocation.

11. Cyclicality

There is published research on the importance of factor cyclicality. The players believe that while factor indexes have exhibited excess risk-adjusted returns over long periods, over short horizons factors exhibit significant cyclicality, including periods of underperformance. The researchers do not shy away from bringing behavioral reasons linked to the shorter investment horizons of the majority of investors which creates inefficiencies that are not arbitraged away[M][50]. Some other players use a multitude of indicators to study business cycles and believe that factor tilting can be used by investors with a shorter time horizon to manage challenges of cyclicality [B][51]. The study of Cycles has been traditionally used by technicians to time trades. Intermarket analysis [61] and sector rotation [62] are established timing tools. Using cycle analysis to suggest factor timing for a shorter horizon is not investing, it is an active strategy that is accompanied by risk.

The behavioral aspect which is used to explain factor cyclicality is also used to exhort the institutional clients to invest for the longer term to benefit from the factor. Some argue the Premia exist to reward long-horizon investors for bearing that risk [M][51]. Cyclicality which starts as a broader risk concept in the product pitches slides into a motive for passive long-term investment. A player suggested that investors who hold such Premia through cycles without being drawn into fads or away from beliefs in bumps in the road, profit [J][52]. Just because the industry is riding a strong wave, many forward-looking opinions seep into the marketing content. There is a limited explanation of duration. The long term is assumed as a convenient holding period that is expected to hedge against short-term cyclicality.

12. Unsubstantiated claims and lack of differentiation

Some players choose to keep their methodology proprietary [J][52] and claim that there is no flawless classification system. Maybe they indirectly refer to this lack of differentiation that troubles the industry. Maybe the industry needs a new classification standard. Some research letter accepts that there is factor proliferation, conflicting explanations of historical outperformance. But most of them consider factors and their Premia as the foundation stones for the investment management industry with strong established economic explanations [J][52]. Some reports do talk about the reduction of Premia but believe it will never be eliminated. The Premia the report talks about has long been contested as potential proxies and both Fama & French admit that they do not know why these Premia work leave aside its reduction or elimination.

Some researchers mention opaque reasons like the “constraint-based” view where a factor can potentially persist only as long as those constraints remain in place [M][51]. The opinion is that a factor can potentially persist indefinitely as it is compensation for bearing non-diversifiable risk. Or a factor can potentially persist as long as there are strong behavioral biases that can not be arbitraged away. This leaves one wondering where to go, to the behavioral side of inefficiency, or to stay as a believer in the efficiency of the markets. A convoluted sales view built around a larger academic confusion regarding efficiency and inefficiency.

Methodologies that claim to be designed to provide capital appreciation are aggressive active marketing that just raises a red flag about the robustness of the investment process [I][63]. Companies that suggest that Factors are time tested drives of returns across asset classes [B][51] need to read Banz (1978)

Not so surprisingly just like Behavioral Finance [64], Smart Finance is not about prediction. The disclaimers talk about hypothetical back-tested Performance [O][49]. Backtesting is a loosely used word in markets. Backtesting for selection systems can not be treated similarly to backtesting for allocation systems. If you are not comparing an apple to an apple, the backtest is not relevant. Should the disclaimer not mention that the hypothetical backtest is not relevant because we are comparing an orange with an apple. There is such a lack of differentiation between the methodologies that sometimes it is hard to understand who came up with what. The Research Affiliates - WisdomTree suit points to this challenge of differentiation.

13. Underperformance, Arbitrage, Free Lunch

Some players have cited factor underperformance. All factor indexes have experienced periods of underperformance and some factor indexes have been highly cyclical. Each of the factor indexes has experienced at a minimum a consecutive multi-year period of underperformance. Some factors historically have undergone even longer periods; the Small Cap or Low Size factor went through six years of underperformance in the 1990s [M][51]. Thus there is no free lunch attached to factor investing.

The assumption of no free lunch in light of a century-long equity premium seems misplaced. And when you link factor performance to equity premium, you are playing a game of musical chairs. A similar circular argument is happening among the academicians [65]. Nobody seems to wonder why these inefficiencies exist and why or when these Premia could eliminate?

14. Granger’s Challenge

Granger (1992) mentioned, “To build a method that consistently produces positive profits after allowing for risk correction and transaction costs and if this method has been publicly announced for some time, then this would possibly be evidence against EMH...Only if a profitable rule is found to be widely known and remains profitable for an extended period can the efficient market hypothesis be rejected...Benefits can arise from taking a longer horizon, from using disaggregated data, from carefully removing outliers or exceptional events, and especially from considering non-linear models.”

So as a first step, Smart Finance needs to make its hypothesis, announce it, and show risk-weighted excess returns. Now, this methodology has to be universal, which means it can not be US-centric and should work across global regions. If it can also do it cross-asset then there is an opportunity to move beyond EMH. Granger’s challenge remains unresolvable.

15. Reversible Framework

If the methodologies are rule-based, systematic then just like one can build risk-weighted excess returns, one can build risk-weighted negative excess returns, which means underperforming Indices. The industry has found a punching bag in the MCAP methodology. Arnott used it and now it has become a standard. MCAP is inferior, our methodology is superior is all fine. However, the challenge is to illustrate how robust your methodology is.

Assuming Smart Finance is smart then it can open up its rule box and explain why MCAP is unequivocally inferior, multi-factor unequivocally better, show apple to apple comparison and come out of the circular argument which transfers responsibility and risk to the institutional client. If Smart Finance can not do it, both behavioral foundation and market efficiency are far from Science. It is simply a compelling narrative that increases risk rather than manages it. Asking for the reversibility test can not only challenge the explanations, but it can call the Smart Finance bluff, a flawed or no hypothesis [67].

Lo’s observations that “Conservation laws, symmetry, and the isotropic nature of space are powerful ideas in physics that simply do not have exact counterparts in economics because of the nature of economic interactions and the types of uncertainty involved.” revolves around the nature of economic interactions and uncertainty. An architecture that allows for interactions and uncertainty to get physics back into the stock market game and disprove Lo.

Symmetry is beautiful. Markets have a mathematical behavior. And rule boxes should bring clarity both on the way up and down. If rules can explain risk-weighted positive excess returns they should be invertible to explain risk-weighted negative excess returns. And if that framework can also explain behavior (interaction) and uncertainty, Finance becomes Physics. Explaining Alpha based on a mathematical system thinking could eliminate the behavioral variable, embrace uncertainty and create a non-arbitrage table premium. The free lunch, will not go away.

Just by referring to human irrationality as a free lunch will not take us anywhere. We need to think beyond subjectivity and comprehend a structure that is designed to find balance despite unbalancing forces because only imbalance keeps it going like clockwork.

16. Physics

The idea of a free lunch is at the heart of Smart Finance, which has struggled with linear thinking [66]. The moment we bring in a non-linear system thinking, we can explain how free lunch can continue to exist indefinitely. Rather it is the absence of the free lunch that can stifle the markets. No free lunch means perfect efficiency, which is not a market. The free lunch comes with a cost and risk.

The first assumption to seek free lunch is to assume that it is System over Behavior rather than vice versa. The system has to be simple, the problem definition simpler. From a Smart Finance point of view, Rich get Richer is risk-weighted excess returns (outperformance) and when the Rich do not get Richer, it risk-weighted negative excess returns (underperformance). The reason this is all Physics is that network science is based on Rich get Richer.

The problem definition. How the Rich get Richer and sometimes that does not happen? How do trends continue but sometimes reverse? Or in other words, how do premiums exist and eliminate? How do networks grow? How does the first move advantage persist? How does sometimes a late entrant challenge the first mover? Or in more scientific jargon, how are phase transitions and power-law connected [67]? From a statistical point of view, the problem definition is why do Reversion and Diversion happen? Why do sometimes markets that continue to grow reverse? How can we reconcile Pareto Distribution with Galton Normality? Why are robust laws sometimes prone to failure?

The System has to be universal. It can not just work on one asset class and not on the other. It can not work in Finance and not in Sentiment. The structure of the system should overrule the content. The whole should be more than the sum.

While Smart Finance has been observing market patterns, physicists have been struggling with questions about universality, an architecture that explains complexity. Herbert Simon (1962) wrote about it first in Architecture of Complexity.

“...details of structure refer primarily to the complexity of the systems under view without specifying the exact content of that complexity...Roughly, by a complex system I mean one made up of a large number of parts that interact in a non-simple way. In such systems, the whole is more than the sum of the parts, not in an ultimate, metaphysical sense, but in the important pragmatic sense that, given the properties of the parts and the laws of their interaction, it is not a trivial matter to infer the properties of the whole. In the face of complexity, an in-principle reductionist may be at the same time a pragmatic holist.”

One of the key ideas of Simon was to understand how Pareto worked. How did the Rich get Richer? Laszlo Barabasi’s work also failed to explain why sometimes there is a divergence from the ‘Rich Get Richer' (RGR), or why does on occasions, the first-mover advantage fails to keep the incumbent ahead. How come sometimes, a non-descript late entrant, a search engine (Google) ends up becoming bigger than the first search engine (Yahoo)? Laszlo Barabasi called it the luck factor. The challenge against Barabasi was brought by Keller, Shalizi, etc. This brought in a need for a new Architecture of Complexity. Something that could explain why sometimes the first mover could fail and the second or late entrant could succeed. In other words, it could also explain how mean reversion worked along with Praetorian divergence (exaggeration of trends).

17. Preferential Attachment and Detachment

A preferential attachment process is used to describe the distribution of wealth among several individuals according to their existing wealth. This is why the wealthy receive more than those who are not. Preferential attachment is known to generate power-law distributions. Since the Rich get Richer is only of the four cases in a natural system, the other three being Rich get Poorer, Poor get Poorer, Poor get Richer, Preferential Attachment can not work alone.

Preferential Detachment is the process that assumes nature as a closed system i.e for someone getting relatively richer, someone is getting relatively poorer. Hence for every preferential attachment, there is a parallel preferential detachment, a decay process that feeds another node’s growth.

18. Mean Reversion Framework

The framework explains how stock market systems could work. The thrashing “Herding” behavior witnessed in universal systems [78] is similar to the near 0% (bottom value) and near 100% (top growth) rankings of the group where Rich (winners) and Poor (losers). The information is below a certain threshold, as losers suffer from lack of interest, lack of trading volume, there is no interest from media, and hence rejection (herding) of losers. The losers remain subdued and do not emerge, revert till the respective information threshold breaks. Small sponsors of trends accumulate the worst losers, pick up contrarian stories, and gradually push the information above the threshold. The more than 80% ranked components generate positive information or shun negative information. Winners attract positivity but at some stage buying or positivity exhausts and the momentum exhausts as the components can not keep up with a certain information threshold to keep buyers interested. It is then that the components rankings push lower sub 80%.

There is “Order” when components move out of extreme winners (down from 80-100 Growth Bin) or losers (up from 0-20 value Bin) rankings owing to the increased information threshold, an order comes in. The reversion from top and bottom leads to momentum. As the sponsor and the smart money gathers size. The initial agents trigger the search for more information increasing popularity for the ongoing momentum trend (up or down). Order precedes and follows the herding behavior. There is “Randomness” when the components in momentum push to the transition bin (20-80) (from top growth or bottom value bins) leaving the information threshold behind, the lack of information now becomes too much information, leading to randomness and disorder. Will the momentum continue? Will the reversion happen? This is the second behavior of a universal system as it moves from a clear momentum to reversion and unclear state where the components of the systems have to choose between staying in momentum or reverting.

Divergence and Reversion in relative rankings create a system, where the Rest (C, Core) throws out its components, while Reversion from the extreme causes the opposite action. The Rest (C, Core) acts as a buffer. On one side, it pushes components to take the place of reverting components (stocks), and on the other side, the components in Reversion from the Winners (Rich) bin are either pushed lower into Core or continue to stay stronger and positive i.e continue to stay at the top, a winner (Richer). A similar process happens when the Losers (Poor) are reverting up. The Rest (C, Core) either assists the component (stock) to gather further positive momentum positive towards further gains or pushes it back into negativity (Poorer). The Rest (C, Core) also replenishes the Losers (Poor) bin by pushing new components to replace the old ones. The cycle repeats.

a) Losers Move Up; Winners Move Down

b) Core Moves Up; Core Moves Down

c) Divergence process begins from Core;

d) Divergence process drives Momentum;

e) Momentum reaches extremes;

f) Extremes Revert; cycle restarts

19. Reversion and Diversion Factor

Behavioral finance agrees that anomalies cannot be identified and exploited on a persistent basis. The behavioral model accepts its temporal limitations. The paper ‘Arbitraging Anomalies’ Pal (2015) explained the circular argument explaining anomalies and how a behavioral explanation of the key anomalies is an extension of the Reversion - Diversion process of stock market systems. The paper explains the five anomalies 1) The equity premium puzzle, 2) Predictability, 3) Dividends, 4) Volatility, and 5) Volume myth as Reversion failures.

The paper ‘Momentum and Reversion’ Pal 2015, explains how Momentum and Reversion have always been seen as independent of each other and never as a composite. The two behaviors are not only connected but also get transformed into each other. These dynamics drive not only stock market systems but all-natural systems. One reason researchers did not see this composite behavior is because of the focus on independent components (asset prices) rather than a group of components (a collection of stock prices) and because of a lack of an adequate framework to illustrate the two key behaviors together. The ‘Mean Reversion Framework’ explains how natural systems witness Reversion and Divergence simultaneously across different periods of time.

Galton’s work talks about relativeness, either in the form of comparisons, ratios, deviations, proportions, degrees, scale, extremes, etc. He goes about giving relativeness more importance than absolute values. Even deviates (deviations) are referred to in the context of comparisons between the variables. The focus is not on the absolute values of the mean but on how they are relatively shifting towards average (mediocrity). The further away the natural data went from the mean the stronger it was to revert.

The rule was simple; positive extreme was prone to revert down while negative extreme was prone to revert up. Convergence was more of focus than divergence. Galton classified his system as organic. There was succession, continuity, and periodicity. There was a context, proportionality, and extremes in the data set studied. There was dynamism between the data sets, increasing and decreasing change, accelerating and decelerating change.

There was a mean relative to the data. Despite the difference and change, the pattern persisted and balanced out, reached a state of equilibrium, compactness. There was a context of top and bottom. There were opposing actions; dispersive and converging forces, opposing tendencies, spring-like action. There was a process of transformation generationally, a process of replacement by the data set to freshen itself up, a sequence of stages. Despite the order, there was a sense of randomness, less scattered data lead to more scattered data and vice versa. Galton’s Reversion is connected to the dispersion in the system. Both forces act together to keep the dynamism going.

His focus is primarily on divergence from mean rather than top or bottom rankings. Galton’s considered Reversion as extremely regular, leading to a state of constancy. Regularity meant that Reversion and Diversion followed a cyclical process. He talked about an alternation between the two. Galton observed or focused on a complete cycle from one generation to the next, from Diversion to Reversion.

Reversion and Diversion is the only factor that can explain the insufficiency in the behavioral model and market efficiency. Reversion and Diversion is the only factor that subsumes every other market factor. There is no factor that does not see varying degrees of change both in its favor and against it.

20. Rich don’t always get Richer

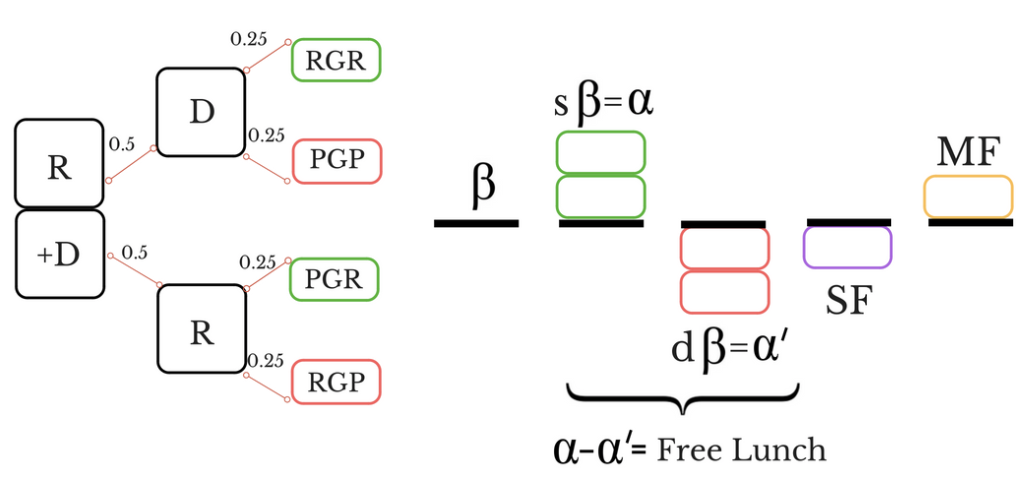

The three components of a natural system encompass the rich, the poor, and the rest. A natural system can not be conceived to just resolve the problem of the Rich get Richer (RGR). It has to resolve the other scenarios that accompany the RGR problem i.e. why Rich get Poor (RGP), Poor get Poorer (PGP) and Poor get Richer (PGR)?

Hence any group (assets, variables, etc.) can be seen as made of the Rich, the Poor, and Rest. This is the only way we can explain the complete problem. In the paper, Markov and the Mean Reversion Framework (Pal, 2015) [81] I explained that natural systems witness reversion and divergence simultaneously across different periods of time.

The paper tested the ‘Mean Reversion Framework’ for Markov’s transition probabilities. The framework exhibits a stable pattern when tested for STOXX 50, S&P 100, Nikkei 225, and FTSE 100 components across different periods of time from 20 days to 3750 days.

The three-bin classifications of the framework; Rich, Poor, and Rest exhibited consistency in the growth and decay pattern. Both Poor and Rich classification exhibited persistence compared to the Rest bin and tended to decay slowly. This was the most interesting observation suggesting that Rich had a tendency to stay Richer in the short term and even after 3 years, half of the Rich group continued to stay Rich. The Poor also despite persistence had a tendency to become Richer in the longer term.

While the Rest bin showed a symmetric decay towards the Rich and Poor bins. Such a probabilistic behavior in group components leads the author to believe that the mean reversion framework is indeed converging and diverging leading to a robust expression of a stock market system. The framework could work across data sets from various domains, confirming the proposed universality of the mean reversion framework.

A substantial part of the three classifications gets transformed into another. The blue being the initial all Rich, the grey being the Poor, and the brown being all Rest. The transition over Year 1, to Year 2 to Year 3 explains how a part of the Rich transform into the Rest while a part of the Rich stay Rich. How the Poor stop staying Poor and start moving towards Richness.

The Rest acts as a buffer staying broadly where it is over a 1, 2, and 3 year period. A three-bin probabilistic classification finds it easy to explain the problem probabilistically. How many Rich will stay Richer three years from now? About 50%. How many Poor can stop being Poor 1 year from the initial state? About 19%. And how many Rest transform into Poor or Rich states in 3 years? About 12% each.

Probabilistic Transformation of Rich, Poor and Rest over 3 Years

21. Factor Simplification

If the three-bin MRF classification can answer the big question of Physics by redefining a simple problem then the five factors of Smart Finance can also be restated as the Reversion and Diversion factor. Alpha is defined by the four stages of every natural system i.e. RGR, RSL, LCL, and LSR. The four stages are driven by the Reversion - Diversion Factor. Hence Alpha is a function of the Reversion - Diversion Factor. All factors and reasoning are subsumed by the Reversion - Diversion Factor.

Reversion and Diversion Factor

22. Factor Causal Explanation

And the Reversion - Diversion factor is not static, sometimes the Rich make more absolute wealth than the Poor who are becoming Richer and vice versa. All the colored Factor thinking is a causal explanation of what is happening. Sometimes a certain Factor (Color) delivers more and sometimes it is another factor that can explain the performance. But all Factor thinking is static and causal. What delivers today may or may not deliver tomorrow. It is all probabilistic and objective.

Conventional factors thinking is causal subjective explanations

23. Smart and Dumb Free Lunch

While the Rich get Richer (RGR) and Poor starts to get Richer (PGR) explains alpha, the Poor gets Poorer (PGP) and the Rich that gets Poor (RGP) explains drags on Alpha or Negative Excess Returns. The symmetry of the framework simplifies the understanding of Alpha. Free lunch exists between the Smart and the Dumb beta as consistent Reversion and Diversion is always creating opportunities for free lunch, which can not be arbitraged away. Because the functioning of the markets is also multi durational, which is why there is inefficiency that could generate arbitrage opportunities. The system design creates opportunities for herding, order, and randomness. And because fear will always be stronger than greed, the free lunch Premia will continue to persist.

Probability Tree

24. Risk, Prediction, and Uncertainty

Prediction is a wasteful exercise when it comes to wealth. Alpha is not a function of timing but risk management. If 80% of the money managers fail to beat the market consistently and Active as an industry is undergoing an overhaul, all predictive ability regarding concentration related to momentum crash are unsubstantiated claims [B][51]. Strong Relative Strength tends to outperform factors with weak recent performance. This is not Science but a trend following. And a methodology that divides the business cycles into four distinct regimes is Intermarket Analysis and Sam Stovall sector rotation repackaged into Smart Beta [B][51]. Institutional clients keen on understanding the relation of factors with business cycles are better off understanding the respective subjects before jumping into methodologies that time factors with the business cycle. A risk-based methodology is unique.

The two key factors (Reversion ad Diversion) are subdivided into four sub-factors viz. RGR, PGP, RGP, and PGR can explain Alpha. RGR and PGR are positive [68] and hence is the optimal Smart Beta, the best-case scenario for excess returns. The RGP and PGP are the drags and hence the Dumb Beta, the worst-case scenario, or the negative excess returns. The challenge today for any Active manager or rule-based Smart Finance manager is to build a methodology that can isolate the Smart Beta from the Dumb Beta. Historically if Active managers have underperformed the S&P500, it is because they are more invested in Dumb Beta than Smart Beta. Or in other words, their rules or selections are inferior.

A large focus on smart selection comes at a cost. A large focus on Diversion, running after trending winners (RGR) comes with the possibility of Reversion and RGP. On the other side, a large focus on Reversion, Poor getting Richer (PGR) comes with a possibility of Poor getting Poorer. There is rarely an optimal balance. This is the reason a part of the industry believes it is of no use to time the market and accepts the MCAP index with its flaws. But according to the MRF MCAP is definitely not the best way to invest, as after all MCAP is also an allocation. Science has to seek smarter allocations. The MRF also illustrates that multi factors are causal explanations and factor isolation is a wasteful exercise. Conventional Factors do not understand market behavior. This is the reason the industry can not differentiate between naive and smart allocation. Both the Smart and Dumb Beta are inseparable. All methodologies have to assume the uncertainty and the risk brought by the Dumb Beta to the investment. Deciphering Alpha is a Science and Science needs system thinking and Architecture of Complexity. Architecture is a way to understand the Science of the Alpha generation.

The dynamism of the market system obliges players to have varied responses. This creates interaction and uncertainty. Divergence is what creates a premium and Reversion is the reason the premium gets eliminated. One can understand Equity Premium better in a group setting which includes all other asset classes. The equity premium is not an aberration and can be understood from a Reversion - Diversion factor perspective. The fact that over anyone decade the equity premium has shown great variability moving from above 19% (the 1950s) to 0.3% (1970s) suggests that just like everything else in nature even the equity Premia persists or changes because of the four sub-factors of the MRF.

The optimal allocation hence becomes an overweighting of the Reversion and Diversion factor assuming the Dumb Beta along with the Smart Beta and compare and apple to apple. This is what the author illustrated in the paper, Is Smart Beta Dumb? (Pal, 2015) [85].

25. Case Study

The study takes three market Indices, S&P100, FTSE 100, and TSX 60. The three-bin classification took the Rich to be the top decile winners and the Poor to be the bottom decile performers. The top Rich decile has both the Smart and Dumb factors i.e. RGR and RGP factors. Similarly, the bottom decile has the PGP and PGR factors. The portfolios are run for a 24-month rolling period. The Premia is calculated as the net of RGR+RGP and PGR+PGP portfolio. The R+D (Reversion - Diversion Factor) portfolio is a weighted average of the RGR+RGP and PGR+PGP portfolios.

Not so surprisingly the MCAP benchmark stays as a composite average stacked between the various portfolios, while the Reversion - Diversion factor portfolios were spread around the benchmark. The time period we have studied illustrates a secular Diversion Factor performance and Reversion Factor failing to catch up. But this could change over a different period of study as the Premia varies in time. Barring US markets, where the R+D marginally outperformed the benchmark the net Premia was more than a free lunch.

26. Conclusion

The failure of Behavioral and Efficiency models combined with the confusion of Smart Finance has left the financial industry without a coherent framework to rely on. Smart Finance is riddled with conflicts regarding the definition of Smart Beta and whether everything away from MCAP is Smart. Above that, the industry’s active focus and desire to package single factor tilts as a solution for short term changing business cycles, multi-factor as long term diversification solutions expecting the institutional client to comprehend his risk and invest, and a multitude of unsubstantiated claims leaves a reader with a sense of shock regarding what is being sold as Smart Finance. Smart Finance has an opportunity to resolve conflicts or be a part of an unintended risk, which the society is not prepared for.

Physics on the other side which a few academicians believe is hazardous for investors wealth has reached critical mass. Now Physics can explain not only why the Rich Get Richer, but also why the phenomenon fails sometimes. The paper introduces the idea of Preferential Detachment, a process that assumes nature as a closed system i.e for someone getting relatively richer, someone is getting relatively poorer. Hence for every Preferential Attachment, there is a parallel Preferential Detachment, a decay process that feeds another node’s growth.

The probabilist framework based on a simple Rich, Poor, Rest classification explains how the Rich gets Richer problem is accompanied by three more problems. How the Rich get Poor, Poor get Poorer, and Poor get Richer? The author uses the Mean Reversion Framework and the Reversion-Diversion factor to simplify Factor thinking, challenge causal subjective explanations of conventional factors, and illustrate how systems could work without a behavioral or efficiency model and rather drive behavior than be driven by it.

The paper uses the RGR system to explain Alpha and how free lunch exists between the Smart and the Dumb beta. And because the functioning of the markets is also multi durational, which is why there is inefficiency that could generate arbitrage opportunities. The system design creates opportunities for herding, order, and randomness.

The paper also carries a case study covering three markets and illustrates a portfolio construction process from the Rich and Poor basket, and the Reversion-Diversion factor and the net Premia between Reversion - Diversion factor portfolio and the MCAP weighted benchmark.

Bibliography

(D) - Deutsche Asset Management

The New Neutral - The long term case for currency hedging

(S) State Street Global Advisors - SPDR MSCI Strategic Factors, ETF Suite

(O) Oppenheimer: Introduction to Smart Beta

From Academia to Practice, the rise of Factor Driven investment vehicles

(A) AQR: My Factor Philippic, Clifford S. Asness

(J) JP (Smart Beta: Evolution, not revolution)

(M) MSCI - Research Spotlight, Foundations of Factor Investing

[B] Expansion, with a side of Jitters, Factor Outlook, BlackRock, July 2016

[I] Invesco. Fund in focus, PowerShares Dynamic Large Cap Value Portfolio

[1] PWC - Asset Management 2020 a brave new world

[2] Smart Beta Trends, Tralio Blog, Pal, 2016

[3] S&P DJ Indices - Indexing Company

[4] Invesco – PowerShares, FTSE Russell, MSCI

[5] ETFs making mutual funds extinct, Business Insider, 2016

[6] The rise of smart beta, Economist, Jun 6, 2013

[7] PWC - Asset Management 2020 a brave new world

[8] Style Box, Morning Star

[9] Is the Style Box broken or fixed?

[10] What is Value?, SSRN, Pal, 2014

[11] Market Technicians, New York

[12] Gamblers of New York, Pal, 2013

[13] The Stock Market Universe—Stars, Comets, and the Sun, John Bogle, 2001

[14] Momentum and Reversion, Pal, 2015

[15] Why hasn’t Active investing outperformed Passive investing in recent years?, CFA Institute, 2015 [16] Do Behavioral Biases Adversely Affect the Macro-Economy?, Korniotis, Kumar, 2010

[17] Is Smart Beta dumb?, Pal, 2015

[18] The Short Index, Pal, 2014

[19] CAPM is CRAP, Montier, 2013

[20] Is Beta dead or alive? Lakonishok, 1993

[21] Two Pillars of Asset Pricing - Nobel Prize Lecture, Fama, 2013

[22] What is Value?, SSRN, Pal, 2014

[23] Irrational Exuberance, Shiller, 2000

[24] Did Behavioral Mutual Funds Exploit Market Inefficiencies? SSRN, Philippas, 2015

[25] “End of Behavioral Finance?”, SSRN, Pal, 2013

[26] PWC - Asset Management 2020 a brave new world

[27] Network Science, The Barbási – Albert model, 2014

[28] Calcul des Chances et Philosophie de la Bourse, Regnault, 1863

[29] The Cross-Section of Expected Stock Returns, The Journal of Finance, Fama & French, 1992 [30] Common risk factors in the returns on stocks and bonds, Journal of Financial Economics, Fama & French, 1993

[31] What is Value?, SSRN, Pal, 201

[32] Fruit Basket Paradox – A term coined by the author to explain the fragmented nature of financial theories.

[33] “Profitability of Momentum Strategies: An Evaluation of Alternative Explanations”.

[34] Arnott, R.D. & Bernstein, W.J. & Wu, L.J. “The Rich Get Poorer: The Myth of Dynastic Wealth”. 2015.

[35] Ball, P. “Critical Mass: How One Thing Leads to Another”. 2005

[36] Newman, M.E.J. "Power laws, Pareto Distributions, and Zipf's law". 2011.

[37] Hayes, B. "Follow the Money". American Scientist. 2002.

[38] Albert, R. & Barabási, A.L. “Topology of Evolving Networks: Local Events and Universality”. 1999.

[39] Albert, R. & Barabási, A.L. “Network Science - The Barabasi-Albert Model”. 1999

[40] Keller, E.F. “Revisiting “Scale-Free” Networks”. 2004.

[41] Clauset, A. & Shalizi, C.R. & Newman, M.E.J. “Power-law distributions in empirical data”. SIAM review, 2009

[42] Simon, H. “Architecture of Complexity”. 1962

[43] Fernandez, P. “CAPM: An Absurd Model”. SSRN. 2015

[44] Asness, C.S. & Frazzini, A. & Israel. R. & Moskowitz, T.J. “Size Matters, If You Control Your Junk”. 2015.

[45] Fama, E.F & French, K.R. “A Five-Factor Asset Pricing Model”. SSRN. 2014.

[46] Shiller, R.J. "Do Stock Prices Move Too Much to be Justified by Subsequent Changes in Dividends?", American Economic Review. 1981.

[47] Baardwijk, M.V. & Franses, P.H. “The hemline and the economy: is there any match?”, Econometric Institute Report, 2010.

[48] Pal, M. “Firefighting and Finance”. 2016.

[49] “Oppenheimer: Introduction to Smart Beta. From Academia to Practice, the rise of Factor Driven investment vehicles”. 2016

[50] “MSCI - Research Spotlight, Foundations of Factor Investing”, 2016.

[51] “Expansion, with a side of Jitters, Factor Outlook”. BlackRock. 2016.

[52] “Smart Beta: Evolution, not revolution”, JP Morgan, 2016.

[53] Pal, M. “Why is CAPM not CRAP?” SSRN. 2015.

[54] Montier, J. “Behavioral Investing”, 2007

[55] Pal, M. “The Size Proxy” SSRN. 2016.

[56] “SPDR MSCI Strategic Factors, ETF Suite”. State Street Global Advisors, 2016.

[57] Clifford, S. A. “My Factor Philippic”. SSRN. 2016.

[58] “The New Neutral - The long-term case for currency hedging”. Deutsche Asset Management. 2016.

[59] Baker, M.P. & Burnham, T. “Optimal Tilts”. SSRN. 2016. [60] Pal, M. “Fruit Basket Paradox”. SSRN. 2016.

[61] Murphy, J. “Intermarket Analysis”. 2004 [62] Stovall, S. “Sector Investing”. 1996

[63] “Fund in focus, PowerShares Dynamic Large Cap Value Portfolio”. Invesco. 2016

[64] Shiller, R.J. “From Efficient Markets Theory to Behavioral Finance”. Journal of Economic Perspectives. Volume 17. Number 1. pp. 83–104. 2003

[65] Pal, M. “Arbitraging the Anomalies”. SSRN. 2015

[66] Cootner, P. “Random vs. Systematic Changes”. 1962

[67] Stanley, H.E. “Introduction to Phase Transitions and Critical Phenomena”. Oxford University Press. 1971.

[68] Edits to be made in updated paper