I was invited to deliver an inspirational speech at the Start-up Weekend for the global Jade network. KJ, a friend of mine, an international expert on e-gaming and netpreneur could not avoid a smirk: “Mukul and inspirational talk?”. He knew me well and was much updated about the contrarian me and our idea of glorifying the worst. Unmindful of KJ’s demotivation, I went ahead and delivered the following speech.

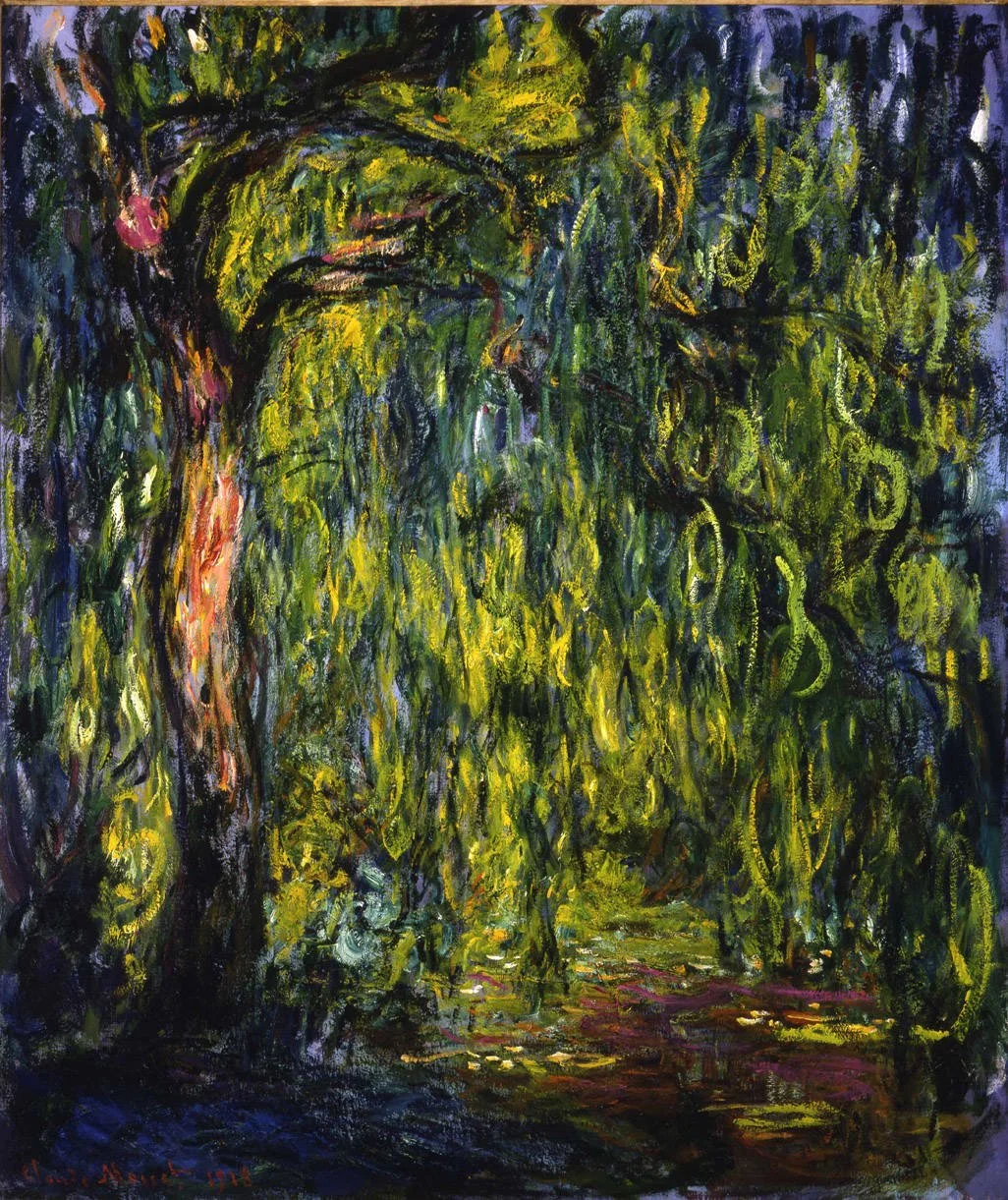

It was sometime in June 2005. I was with my partner in an art museum, looking at the picture of a Salcia tree. Salcias are a predominant species here in Cluj. She told me about the Greek tragedy (Death of Eurydice) linked with Salcia, popularly known as ‘The weeping willow’. We were looking for a name for our company and, after hearing the tragedy, I started considering the idea ‘The Weeping Willow Inc.’ I foresaw an economic tragedy and saw a perfect fit. But then we are in the age of euphemisms, hard truths can be bad for business. This is how we chose ‘Orpheus’ as a name for our company.

Now, seven years later, sorrow seems to have transcended from the painting on the wall to austerity and debt worries, which are driving Greek pensioners to suicide. We are living tragic times, where more than 40 percent of Spanish youth in the age group 15-24 are jobless. One might say India is another world.

It’s an illusion. Almost half a billion Indians are young. You should read the recent TIME story on ‘Children of the New India’. Disappointments rarely make headlines, until it creates Mohammed Bouazizi or the Tibetan youth immolating himself in Delhi, protesting Chinese interference in Tibet.

This could also seem disconnected to the economic reality. But it’s not. Economics 101 (a basic course on economics) says bailouts create cheap money, which creates inflation and a high cost of living. The state has failed, the resources have diminished, change is getting dramatic and what we see are just sparks of success in a darkness of failures. “By underplaying adversity, the self-esteem movement has done a disservice to an entire generation.” We sold the excitement of triumph instead of teaching our young how to deal with adversity. The protected youth suddenly find themselves underprepared for the unpredictable and unable to comprehend resilience.

But then time is a great teacher. All those who never witnessed adversity, here it is, the age of adversity. What the new generations need is to relearn the discipline of Odysseus, pick up insights from the marshmallow experiment, overcome instant gratification, learn how to pass the Solomon Asch three-line experiment and pick up many more virtues.

A recent Forbes article reports that 40 percent of Gen Y investors agree with the statement, “I will never feel comfortable investing in the stock market.” Wow, never?! The article states the average Gen Y investor holds 30 percent of their assets in cash, an allocation more consistent with an aging boomer than a 20-something. According to Karin Rasi, "While their stance on the equity markets may eventually soften, it’s a strong indication of the understandable — but really unfortunate — risk aversion that now plagues many Gen Y investors."

Adversity, like everything and anything, is cyclical. After a generation of disinflation and prosperity, the iPhone generation is waking up to a new reality. The faster it understands that 80-20 rule even works for success and failure, the better prepared it will be for adversity. Every generation has its weeping willow stories. The challenge is whether the new generation learns from the last.