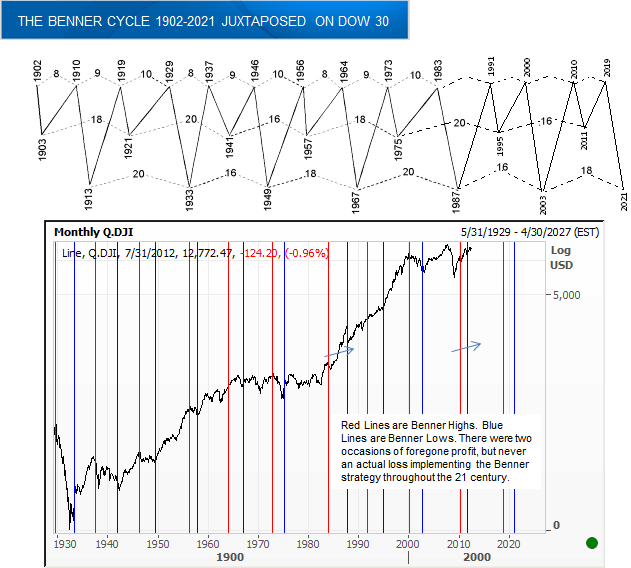

Benner’s Prophecies – Future up and down in prices was written in 1875. Samuel Benner was a prosperous farmer wiped out financially by the 1873 panic. He turned to wheat farming in Ohio and took up the statistical study of price movements as a hobby to find, if possible, the answers to the recurring ups and downs in business. He noted that highs of the business tend to follow a repeating 8-9-10 yearly pattern. With respect to economic low points, he noted two series of time sequences indicating that recessions (bad times) and depressions (panics) tend to alternate. The panic years reflect a repeating 16-18-20 pattern. E R Dewey, Director of the Foundation for the Study of Cycles, assessed Benner’s pig iron price forecasts over a 60 year period and regarded this cycle as showing the gain-loss ratio of 45-1, which was “the most notable forecast of prices in existence”. Benner’s cycle worked well throughout the 20th century and was a very good indicator of US crises and/or recessions. These cycles were aligned with observed chronological trends. Frost and Prechter republished the Benner Cycle and updated it in 1978. We have updated the Benner cycles. They suggest a top in 2010, a slowdown and low in 2011 a cycle high again till 2019 and then low in 2021. But before the low, the Benner cycle suggests multi-year prosperity. The Benner cycle does not work on Gold, Oil, and currencies.